No problem. Request a PDF copy of The Ultimate Guide to Managed IT for Financial Institutions by filling out the form.

Send a PDF copy of this guide to:

In just a few decades, the financial industry saw the introduction of online banking to the release and boom of cryptocurrencies. These changes, although convenient, come with threats and have made it necessary for financial institutions to obtain quality IT.

As a Managed IT Service Provider (MSP), Intelligent Technical Solutions (ITS) understands the need for a secure network, especially in the finance industry. We can help you manage your technology and find suitable security solutions with Managed IT.

In this comprehensive guide, we’ll dive deep into Managed IT and why it matters for financial institutions.

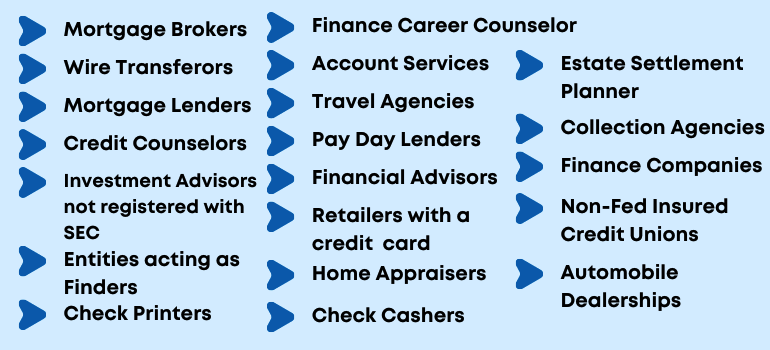

This guide is specific for business owners in the finance sector, including:

More specifically, this guide is for financial institutions that are looking to:

A Managed IT Service Provider (MSP) is a form of outsourcing where businesses hire a third-party organization to take over all or parts of their IT services.

These Managed Service Providers offer a wide variety of services, from data security to communications management. When deciding if or how much to outsource when hiring an MSP, it is important to know the types of managed service providers and the services they offer.

This type of service provides a broad range of options, from video calling and messaging software to email services. Some MSPs can act as a third-party call center for their clients looking to outsource this aspect of their business.

In 2020, cybercrime has risen by 600% since the pandemic began. Almost half of those attacks targeted small businesses. Regardless of the size of your organization, it is vital now more than ever to secure your network.

With that in mind, MSPs often offer critical security services, including managed firewalls, intrusion detection, virtual private network (VPN), and antivirus services. They can also help scan your network for vulnerabilities and recommend solutions to bolster your cybersecurity efforts.

An MSP will be monitoring your systems to help you stay on top of potential internal or external attacks as well.

Data analytics is one of the top three services small to medium businesses (SMB) seek from MSPs, and for a good reason. According to a study by MicroStrategy, 64% of the companies that utilize data analytics reported that it helped improve their efficiency and productivity. Over half of the respondents believed it allowed them to make more effective decisions faster and led to better financial performance.

Some MSPs are equipped with the tools and services that can help you tap into the benefits of effective data analytics.

This service can help remotely manage your print operations and help cut down on many hidden costs. Some of these services include:

Cloud-based services are the perfect solution for organizations that need mobility, like those opting for remote offices. It allows your team to share files and access data anytime and anywhere. Some MSPs offer cost-effective cloud solutions to help you securely access your data.

Voice over Internet Protocol (VoIP) is a technology that lets anyone place phone calls over an internet connection. It provides a host of capabilities analog landlines can't offer and does it for less than half the cost. With features like video conferencing and mobile device integration, VoIP has become the most popular telephony solution for businesses.

Whether you need a physical receiver or just software, an MSP can host the service and tailor it to your specific business needs.

Connectivity is a must in today's business landscape. Having your network managed by an MSP means less downtime, more security, and improved connection quality. Simply put, it helps your business stay connected, reducing your headaches and allowing you to focus on areas that matter most, like growing your business.

Data breaches and leaks are among the top threats looming over the finance industry. This industry is one of the top targets of cyberattacks, only behind healthcare, due to the amount and value of the data they hold. To mitigate such risks, partnering with MSPs is ideal, even if you already have a designated IT department. Managed IT providers have access to broader tools and techniques that can significantly increase data security.

There’s more to cybersecurity than protecting client data and deflecting attacks; one of these is proactive maintenance. This is a service that focuses on preventive measures, not only against cybercrime but also against problems and delays in operations. A managed IT provider can easily detect and flag potential issues and resolve them before they cause significant damage to your system.

Trends change over time, and these days, they change fast. This means that your IT systems will have to adjust accordingly. These adjustments can either be downward or upward, depending on your needs. Either way, it is best to have an expert assist you. A third-party IT provider that consists of knowledgeable consultants is sure to make any transition, whether expansion or downsizing, easy.

The finance industry is highly regulated. This is because each institution can hold thousands to millions of highly confidential client information that, when maliciously handled, can cause a large-scale mess. To ensure that you prioritize the protection of these data, regulations are in place that you must follow. Third-party managed IT providers can ensure that your systems and internal regulations stay compliant.

When you hire an MSP to handle your data and equipment, you’re basically giving them access to sensitive business data. While this is necessary for them to provide you with the best services, some may see this as an issue, especially if the nature of your business puts a premium on data security and control of information.

Most MSP companies are not local to your business, so often, support is not as immediate as having an on-site IT team. Your business needs to go through a process that usually involves calling someone or getting a ticket, then waiting for people to get back to you. However, going through this process gives an opportunity for would-be hackers to get into your network.

You’ll need Managed IT if you are:

On the contrary, here are the possible reasons why an MSP is not a good fit for you:

Service time is the amount of time dedicated to conversations between you and your MSP with the goal of fixing a problem or concern in your IT infrastructure.

An MSP provides different kinds of support, and as a business owner, you need to figure out the amount of service time needed for your company. To do that, answer the following questions:

Price range for service time:

Service time can be billed hourly or be a recurring cost. If you’ve hired a break-fix company instead of an MSP, you’re most likely on an hourly rate. The price ranges from $150 to $250 per hour but can go up or down depending on the company you’ve hired.

Managed IT Service Providers will include service time in the plan that you got with them. Plans can range from $50 to $150 per user per month, with other fees depending on what your IT infrastructure needs.

Make sure you check how much time is allotted for service in your plan and evaluate if that is enough for your needs.

More users mean more devices to manage, which means a higher price point. To have an idea of the cost, you should do an inventory of how many workstations you want your MSP to manage.

Price range for each user:

The price range for each user depends on what you’ll have managed. Perhaps you want to set up a VoIP (Voice Online Internet Protocol), or you want to upgrade your workstations. You might even want to install business internet instead and have mobile device management.

You can expect to spend $50 to $400 per user. You’d also need to coordinate if your fees are one-time payments or if they’ll recur each month.

The number of servers can dramatically affect the price of support. Just like an increase in the number of users will cause an increase in the price, having more servers will cause the price to go up as well.

You’ll also have to figure out if you want your MSP to simply manage the server or include other important features for data security, such as different kinds of backups. If you don’t have a server, your MSP will recommend you get one, as having a server is essential for most companies with data.

Price range for a server:

You can expect to spend as low as $5000 to over $20000 to set up everything you need for one server. As usual, the cost for a server can go up or down depending on the kind of equipment you choose to invest in.

MSPs usually provide a much lower upfront price for servers, with the pay-off of having a monthly fee for the time that you use the server. For example, at ITS, our cloud servers start at $185 per month, while a Backup and Data Recovery (BDR) server will start at $200 per month. Other MSPs will also have price ranges between $200 - $500.

When looking into the pricing of an MSP, you also need to review how much data you want your MSP to manage and backup. Like users and servers, more data requires more equipment which then requires more management and a higher fee.

Data needs to be managed because many issues like cybercrimes, faulty equipment or software, or human errors come up that can affect your data’s accessibility. You need to ensure the security of your company’s network, and prepare in case you lose it.

But while retaining backups sounds great, it can get quite costly to have all the data storage needed for your backups and your regularly used data storage.

Price range for data storage:

You can expect to spend anywhere between $5 per month (for directly bought cloud storage with no maintenance) to $500 (for maintained data storage with backups). Your price will also vary depending on the company you’re coordinating with.

After taking the previous four factors into consideration, you will also need to review what kind of service you need from your MSP.

Will you be working with them to improve your network’s security?

Are you going to ask them to set up your entire IT infrastructure?

Will you need cloud services or VoIP services?

Once everything is set up, you will need to consider technological upgrades. For example, the world has seen the transition from Windows 7 to Windows 11. Eventually, you will need to replace your computer or server with newer technology to adapt.

Additionally, you will need to adhere to changes in government regulations like FTC Safeguards Rule and CMMC. Recently, the Federal Trade Commission (FTC) announced the Safeguards Rule changes for businesses. In the future, you can expect and prepare for several modifications to ensure up-to-date cybersecurity.

Price range for services & upgrades:

The price range for services will wildly vary. You can expect to spend anywhere between $50 per month to $1000 per month, depending on the size of your company and the services you need. These costs can, of course, go up if your company has a lot of users or has specific, intensive, service needs.

Deciding whether to partner with an MSP is one thing, choosing which one to partner with is another. You are basically entrusting your IT to someone outside the organization so it’s critical to find someone that you trust and can meet your specific needs.

So before signing that contract, here are some tips for finding the best MSP for you.

Check customer reviews

Find their service & price list

Look up their certifications

Schedule a meeting

As with other purchases you make, it is important to check other customers' experiences with the company before hiring an MSP. Good reviews from various people are a sign of a company doing things right.

If there are other banks or financial institutions partnered up with your potential MSP, then you can ask them for their experience.

.jpg?width=2000&height=1333&name=finance_how%20to%20choose_step1%20(Smiling%20multiethnic%20colleagues%20busy%20working%20on%20paperwork%20discussing%20project%20business%20ideas%20in%20office%20together).jpg)

Check if their services and price point are a match to your expectations. By checking this immediately, you can easily remove or add a company to your list of potential partners.

.jpg?width=3000&height=1798&name=finance_how_step2%20(price%20wood%20blocks).jpg)

Another thing you should look into when finding an MSP is their team

of experts. Are their IT technicians certified? Are they capable and available at all times? By checking what their staff can do, you can evaluate if their claims can be backed up by their staff.

.jpg?width=3000&height=1996&name=finance_how_step3%20(businessman%20signing%20contract%20paperwork).jpg)

This last tip is crucial. Before setting up a meeting with a potential IT Partner, make sure that you have prepared a list of essential questions

to ask the MSP.

If possible, try to visit your MSP's office or at least have a video

conference with the team involved in providing support for your

company. This allows you to see their work environment and verify

their expertise.

.jpg?width=3000&height=2000&name=finance_how_step4%20(Happy%20couple%20having%20a%20meeting%20with%20financial%20advisor%20in%20the%20office).jpg)

There are a lot of things that go into finding and getting the right provider for your business. And we’re here to help you every step of the way.

At ITS, we help hundreds of clients make intelligent choices about their technology. If you want to know where your financial business currently stands and how we can help you find a suitable IT solution, schedule a free network assessment with us today.

.jpg?width=2000&height=1333&name=finance_bofu%20(Boss%20or%20ceo%20shake%20hand%20of%20male%20employee%20congratulating%20with%20job%20promotion%20at%20work).jpg)

There are a lot of things that go into finding and getting the right provider for your business. And we’re here to help you every step of the way.

At ITS, we help hundreds of clients make intelligent choices about their technology. If you want to know where your financial business currently stands and how we can help you find a suitable IT solution, schedule a free network assessment with us today.