Cyber Insurance vs. Crime Insurance: What Your Business Needs to Know

September 7th, 2023 | 5 min. read

%20-%202023-09-05T005808.675.jpg)

As a business owner, you are likely familiar with various insurance options available to protect your enterprise. Two of the most critical types of coverage are crime insurance and cyber insurance. Both are crucial to create a strong safety plan that deals with issues that could hurt your business such as theft and breaches.

While they might seem similar at first glance, they address distinct aspects of risk management.

As a managed IT service provider for twenty years, Intelligent Technical Solutions (ITS) has been helping hundreds of businesses make informed decisions to fortify their networks against potential threats.

That's why in this article, we sat down with Sean Harris, ITS’ Senior Vice President for Cybersecurity, to delve into the key differences between crime insurance and cyber insurance when it comes to the following:

- Nature of risks

- Types of losses

- Scope of coverage

After reading, you should be able to identify which type of insurance you need to get for your business.

Cyber Insurance vs. Crime Insurance

Crime insurance usually covers physical and financial damage, while cyber insurance covers financial and reputational damage and may include recovery services. However, the differences are often so nuanced that they overlap.

“There are probably quite a few crimes that would be covered by both crime insurance and cyber insurance. If you’re looking at a Venn diagram, [crimes] would be in the middle,” Harris says.

What is Cyber Insurance?

Cyber insurance is a specialized coverage designed to protect businesses from the far-reaching financial and reputational impacts of cyberattacks and data breaches. Its key features include protecting your business from:

-

Data Breaches

Cyber insurance provides coverage for the costs associated with data breaches, including notifying affected parties, credit monitoring services, and public relations efforts to mitigate reputational damage.

-

Cyber Extortion

If your business faces cyber extortion attempts, where hackers demand a ransom to prevent or stop a cyberattack, cyber insurance can cover the ransom amount and related expenses.

-

Business Interruption

In the event of a cyber incident that disrupts your business operations, cyber insurance can compensate for lost income and additional expenses incurred during downtime.

Related: Does My Company Need Cyber Insurance?

What is Crime Insurance?

On the other hand, crime insurance, also known as fidelity insurance, focuses on protecting your business from financial losses resulting from criminal activities committed by employees or third parties. It covers a range of offenses, including theft, fraud, embezzlement, forgery, and more.

While it can encompass internal and external threats, crime insurance primarily centers on physical actions and tangible assets. It mostly addresses the following crimes:

-

Employee Misconduct

This aspect of crime insurance addresses the financial repercussions of employee theft, embezzlement, or fraud. It offers coverage for losses caused by dishonest acts committed by your employees.

-

Third-Party Fraud

Crime insurance also provides coverage in cases where external entities, such as clients or vendors, engage in fraudulent activities that result in financial losses for your business.

-

Forgery or Alteration

If your business falls victim to forged or altered checks, documents, or securities, crime insurance can help mitigate the associated losses.

What are the Key Differences Between Cyber Insurance and Crime Insurance?

To make it easier for you to identify which type of insurance you will need, here's a breakdown of the key differences between the two:

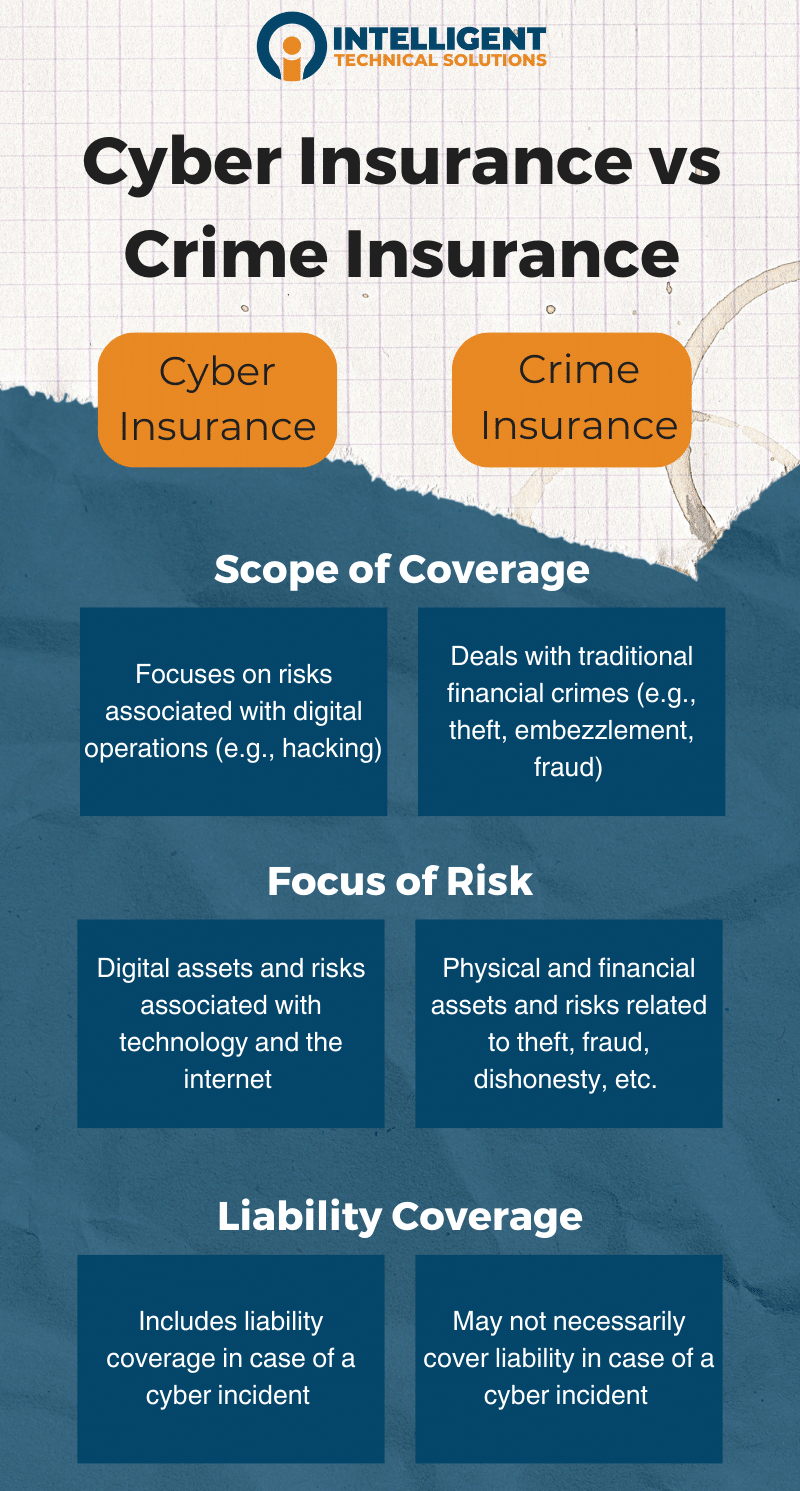

1. Scope of Coverage

As mentioned, cyber insurance focuses on risks associated with digital operations. These are data breaches, hacking, cyberattacks, and the resulting financial losses. It also covers costs related to legal expenses and public relations efforts to manage the aftermath of a cyber incident.

Crime insurance, on the other hand, deals with traditional financial crimes, including theft, embezzlement, forgery, and employee fraud. It primarily addresses physical and financial threats that can impact a business's bottom line.

2. Focus of Risk

Cyber insurance focuses on digital assets and risks associated with technology and the internet. In contrast, the focus of crime insurance is on physical and financial assets and risks related to theft, fraud, and dishonesty, both internal and external.

3. Liability Coverage

Cyber insurance often includes liability coverage, which helps cover legal expenses and damages that a business may be obligated to pay if it is sued because of a cyber incident, such as a data breach affecting third parties.

Crime insurance may not necessarily cover liability arising from data breaches or cyber incidents. It focuses more on compensating the insured for direct financial losses.

Which Insurance Do You Need?

Or the more pressing question is, do you need both cyber insurance and crime insurance?

“If you’re going to buy cyber or crime insurance, you have to identify what risk you have and determine if it makes sense [for your business],” Harris says.

Ultimately, evaluating your business's unique vulnerabilities and risk exposure will help you determine whether obtaining both crime and cyber insurance is a prudent choice. An in-depth discussion with an insurance professional can guide you toward making the most informed decision to ensure your business's resilience against various forms of risks.

Why Do Some Businesses NOT Want to Get Insurance?

While it has been established that every company needs some type of insurance, some businesses might still hesitate to invest in one due to several reasons:

1. Acceptance

“You know what? This could happen, but we think the odds are so low that we are okay with that happening.”

This line of thinking, although understandable, can potentially overlook the true impact of an unforeseen event. Because while the odds of a specific disaster occurring might be low, the potential of its impact could be excessively high, affecting both the physical, digital, and reputational aspects of your business.

Insurance provides a safety net that can cushion the blow and facilitate recovery in the aftermath of a disaster.

2. Overconfidence in existing risk mitigation strategies

“We set good password policies, we have multi-factor authentication, and we have good backups if we get ransomware – it’s less likely that we’re going to get it. And if we do, it’ll probably not disrupt or end our business.”

Businesses that have implemented strong security measures might feel that they're adequately protected against potential disasters. While prevention is essential, it's important to recognize that no strategy is foolproof. Insurance serves as a safeguard, providing financial support if preventative measures fall short.

3. Budget constraints

“Our budget is allocated elsewhere.”

Many businesses, particularly smaller ones, worry that insurance premiums will strain their budgets. While insurance requires a financial commitment, an uncovered disaster could be a far greater financial burden.

Exploring different coverage options and working with insurance professionals can help tailor a solution that aligns with your budget while providing the necessary protection.

4. Self-insurance

“If this did happen, that’s okay. We think it’ll cost one million dollars to get us back up, so instead of paying insurance, we’re going to set aside a million dollars.”

Opposite to the third reason, self-insurance requires high financial stability and discipline. While this might work for smaller incidents, it can quickly backfire when faced with catastrophic events. With established expertise and financial resources, insurance providers offer protection that self-insurance may struggle to match.

Do You Need Help with Your Cyber or Crime Insurance?

While both crime insurance and cyber insurance aim to protect your business from potential risks, they cater to distinct facets of today's complex risk landscape. And as a business owner, understanding these differences will empower you to make informed decisions about the types of insurance coverage your business needs to ensure its long-term security and resilience.

At ITS, we always push for better cybersecurity. And it’d be negligent of us to overlook cyber or crime insurance as part of a holistic cybersecurity program.

If you want to learn more about different types of insurance, check out the following resources:

- 6 Things to Prepare for Cyber Insurance, and Why They're Important

- How to Choose the Right Cyber Insurance for Your Business

- How Much Cyber Insurance Does Your Business Need?

But if you want specific advice regarding your company’s cybersecurity and the role cyber insurance will play in it, get a free cybersecurity assessment today.

Jess is a Content Writer who commits herself to creating helpful, relevant, and easy-to-digest technical articles. When she isn't writing, she devotes her energy (and money) to collecting K-Pop photo cards, which she likes to call an 'investment.'

Topics: